How much money you need is one of the top things students worry out about when it comes to study abroad. Many of us are already practically bankrupting ourselves to get through college, so it can be daunting to add something else on top of it.

The good and bad news is that every semester abroad can totally vary in cost. Where some students blow $30,000 on one semester, others end up actually saving money by going abroad. On top of that, everyone pays for their situation differently. Some students have scholarships, grants, rich aunts, etc. and will only need to worry about spending money while abroad, versus other students will need to save up for the whole kit and caboodle.

So, how do you really figure out how much money to save up for study abroad? There are a ton of factors to consider, so we’ll run through the whole list to get you on the right track.

Upfront Study Abroad Program Fee

This is hands down the biggest price tag of studying abroad and the place where there’s the most differentiation between the overall price tags. To understand the costs, you need to first understand the differences in programs and figure out which you are part of:

- Internal program: Hosted by your home university, an internal study abroad program is considered an extension of your major or department. These are usually lead by your university’s own faculty, only include students directly matriculated at your university, and charge around what your normal tuition would be. Financial aid can apply to this type of program.

- External program: Hosted by third party businesses, an external study abroad program has no affiliation with your home university other than the program provider is qualified to transfer academic credits. These are lead by employees of the program provider (not your university), are open to whomever the provider wants to accept, and charge whatever they want. Financial aid doesn’t usually apply to this type of program.

- No program/direct matriculation: There is a small outlier of study abroaders that is super independent and doesn’t use a program, but instead works directly with the host university to matriculate right into the school. Obviously if you take this route, then you are a student of this university and your costs will be à la carte and out of pocket (or up to that university to award financial aid).

Which type of study abroader are you? This will help you answer a ton of questions as you go through the planning process.

If participating in an external study abroad program, what is the program cost?

Every external program has a flat fee that participants need to pay that usually covers tuition at the host university, an on-site orientation, on-site support during the program, and some cultural activities throughout the semester. What will determine how much money you need to save up is really what your program cost includes. Every program is totally different, and while some might include the full suite of accommodations, food, weekend excursions, etc., others might offer the bare minimum.

If participating in an external program, what is the home university cost?

Do you still have to pay tuition to your home university while you’re abroad? This alone can easily double the cost of your semester abroad. If not, do you have to pay a deposit to “hold your spot” while abroad? This is much more common than having to pay full tuition. Most universities just care about covering administrative fees while you’re abroad, so this is more like an extra few hundred dollars rather than full tuition.

An important note to make– depending on how your home university’s tuition compares to the external program costs, you can actually save money by studying abroad. If you’re attending a private college at $60,000+ per year and then you study abroad through a program that charges the average of $13,000 per semester, look at all that money you’re saving. This could be more substantial if you’re studying in a country with a cheaper cost of living, where program fees could be more like $8,000-10,000. Be sure to take this into consideration when budgeting!

How much is the deposit for your study abroad program?

There’s almost a guarantee that you’ll need to submit a deposit well in advance of when your program fees are actually due, so be sure you’re budgeting accordingly. These deposits aren’t usually refundable, either.

Budget for health insurance

It is extremely uncommon for anyone who is a full-time student of any school to not have mandatory health insurance. If you purchase your health insurance through your home university and you’re going on an internal program, you most likely don’t need to add anything extra to cover you internationally.

However, if you’re going on an external program or not using a program at all, then you probably do. Some external programs offer this as part of the program fees, so check with your provider. You might think you won’t need this, but try wearing heels on cobblestone streets after drinking one too many or putting your eyes underwater in the Dead Sea. You’re not going to want to pay these ER bills on a college student’s budget.

PIN THIS, THEN KEEP READING…

Travel to/from Host City

Physically getting to your study abroad location is one cost that most people are quick to overlook. Studying abroad halfway around the world always sounds super exciting and exotic until you remember that you probably need to pay to get there.

If flights aren’t included in program fees

You might be from Maine and studying abroad in Quebec, in which case you only need to think about a train ticket. Or, you could be from Kansas and studying abroad in Zimbabwe, in which case you better be prepared to throw down $2k for a plane ticket. Some study abroad programs have relationships with airlines so they receive cheap group tickets, while others will leave transportation completely up to you.

Our guide to finding cheap flights for study abroad is a must-read if you’re on a budget.

If airport transportation isn’t included in program fees

Along these same lines, you still have to get to your final destination after arriving at the airport. Does your program include airport pickup? If not, are there buses/trains that go to your city from the airport? Will you need to then take a taxi on top of it to get from the train/bus station to your new home? Even if it doesn’t look that far, are you a serial overpacker who will undoubtedly be towing two 50-pound bags? You’re not going to want to walk those “short 12 blocks” from the train station to your new home under these conditions.

If you don’t have a passport already

Since a passport is part of the standard documentation needed to enter pretty much every country, it’s rare that a program would include this cost. Depending on your home country, a passport could be anywhere from $20 to $200. This price increases significantly the quicker you need your passport, so don’t wait until the last minute if you’re trying to save some money.

If a visa is required but isn’t included in program fees

The cost of a student visa can vary wildly from country to country, so the level of support from study abroad programs can also vary. Some programs include this in your program fees and will even handle the application for you. Other programs won’t include anything.

Regardless of the support offered, you will want to take your visa requirements seriously. You might be confused if your program is requiring a visa but you’re reading on Google that you don’t “need” a visa if you’re there for under 90 or 120 days. Always listen to your program provider!

What Google isn’t telling you is that even though it might not be required from a government standpoint, it probably is required from an academic standpoint. You don’t want to find out after the fact that your credits won’t transfer because your host university didn’t recognize you as a legit student.

If reciprocity fees are required to enter host country

Not all governments get along, which means that some resort to charging foreigners from certain countries a reciprocity fee, or a glorified entrance fee. These can range from a few dollars up to a few hundred, but are usually good for 5-10 years.

If a reciprocity fee is required, you usually have to pay this when crossing through your host country’s border control. These are usually paid in cash only, so be sure you’ve taken out the proper amount before getting on the plane. You can’t bank on there being an ATM before border control! Some countries, like Brazil or China, actually require this fee to be paid before they will release your visa, and this usually isn’t possible at the border.

An insider’s tip: research if the reciprocity fee for your host country is charged across the board or just at certain points of entry. Some countries only collect them at airports while others collect at all entrances regardless of mode of transportation.

If there is wiggle room in your host country’s situation, don’t be afraid to get creative…just don’t forget that you’ll have to pay it anyway if you plan on flying anywhere on weekends/school breaks to get back into your host country.

Living Costs While Studying Abroad

Everything you do at home to function on a daily basis, you’ll need to do abroad, too. Think about everything you are besides just a college student and that’s what you’ll need to plan on spending abroad – at a minimum.

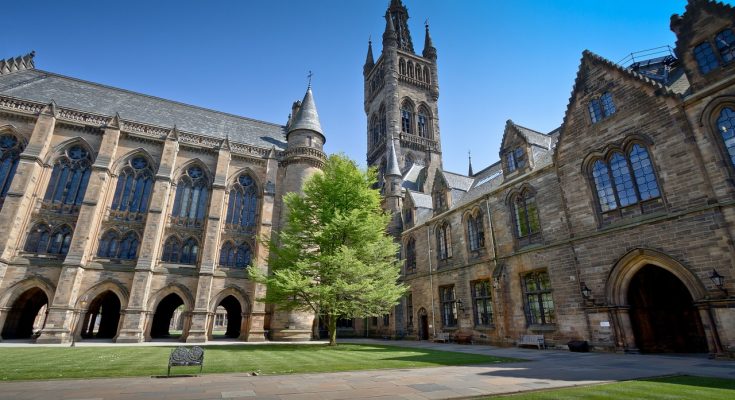

Housing for your study abroad semester

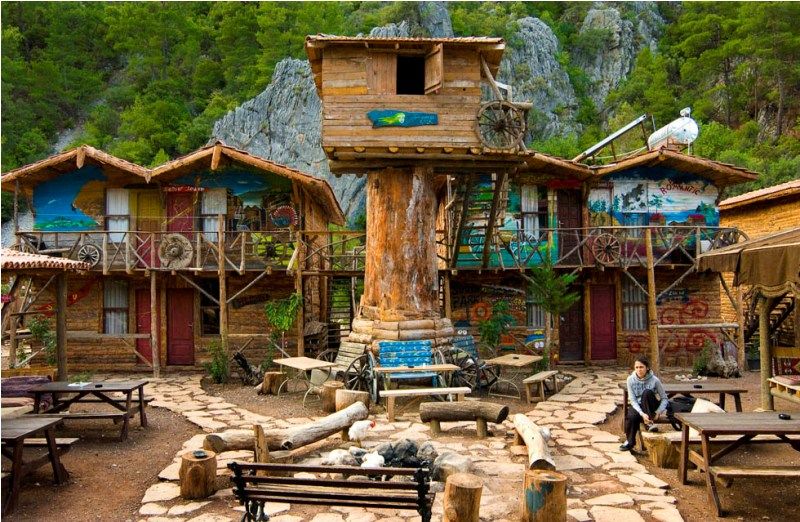

Is housing included in your program fees? Awesome. If not, this cost can range significantly. Living with a host family will usually give you the best bang for your buck because you’re sharing costs with other people and you’ll have a whole house/property to use. This is also the best route for your cultural immersion, too. International student dorms or shared apartments will also help you keep costs down but you’ll probably get less for your money.

If you’re renting a dorm room or apartment, keep in mind utility payments. Do you have to cover electricity, heat, trash, internet, etc. or are these included in your rent? Are there extra things like tourist/non-resident taxes that you need to pay? These seemingly minor extra costs can really add up, so be sure to talk to potential landlords about these before signing a lease.

Food and transportation

If housing is included in your program costs, that usually means at least some of your food will also be covered. Program providers frequently group these together, so if you’re in a host family they will cover breakfast and dinner, or if you’re in a dorm they will provide monthly meal stipends, for example. Regardless, you’ll still have to spend some on food.

If this isn’t the case and you have to purchase all of your food, then think about your grocery habits at home and try to stick to this. Just because you’re abroad doesn’t mean you should be spending a ton of money out at restaurants.

The same goes for transportation. Some programs will provide a student discount/stipend for public transportation passes while others will leave it up to you to decide how to get around. You will need to plan for not just general travel around your host city, but especially the daily to/from school since this will be part of your lifestyle. Most cities offer weekly or monthly transportation passes, so these can be much more cost-effective than buying a ticket for every ride.

General life and technology

All of the products you use at home, you’ll need abroad as well. Think personal items, cosmetics, feminine products, medications, contraceptives, you name it. Consider your normal spending habits at home and then adjust that number according to the cost of living in your host area to get an idea of what you’ll be spending. Keep in mind not all products are readily available around the world (or even available at all), so either you’ll pay more or your habits will change.

You will also need to plan for everyone’s favorite topic: laundry. Since you’re (hopefully) not bringing your entire wardrobe abroad, you’ll probably go through your clean clothes a lot quicker than you’re used to! You might be fortunate in that this could be included in your accommodations, but it isn’t the case for everyone.

The study abroad world has totally changed with the smartphone revolution. Where most students used to leave their “nice” phones at home and buy cheap track phones while abroad, students now aren’t leaving home without these. This can come at a price, though.

Wifi has become more popular around the world, but you can’t bank on this and you’ll need some way to use your smartphone off wifi in case of emergency. Plan on purchasing an international SIM card or upgrading to an international data plan so you can #doitfortheinsta wherever you are.

Don’t forget about the “study” part of “study abroad”

No one really wants to think about this, but you’ll be in class full-time just like at home, so you’ll need to budget for anything while in school. Think general school supplies, textbooks, maybe even library or co-working passes, you get it. It doesn’t hurt to plan for some type of technological malfunction just in case…you never know when you’ll lose your laptop charger or puke on your iPad.

There’s a ton more that goes into your “college life” than just school, right? It might come as a surprise, but most universities outside of the US aren’t these all-inclusive hubs. Most focus pretty much exclusively on academics and maybe will have some cafes or general lounge areas for their students, but that’s about it besides classrooms.

Things like clubs, extracurriculars, fitness centers, and (brace yourself) sports are usually not part of the university and offered at the community-level instead. This means what you might have counted on being free before probably won’t be abroad.

Fun and Adventures While Studying Abroad

Now that we’ve covered all the #adult parts of studying abroad, you get to plan for the fun part: exploring the world!

Study abroad program excursions

Most programs include some type of adventures or weekend excursions that are part of the program costs. However, you still will most likely need to pay something for these at some point, whether it be for food, nightlife, souvenirs, etc.

Experiencing your host city

The best part of studying abroad is that you have this whole new part of the world to explore. You’ll definitely want to get out there and experience all that your new home has to offer, so plan on having some spending money to burn. Between entertainment, nightlife, the occasional restaurant, and general tourism around the city like museums and top sites, that money will be (too) easy to blow through.

Weekend/vacation travel

The same thing goes for extended travel: you’ll have weekends and school breaks/holidays off, so we promise you’ll want to experience as much as you can. With new budget airlines springing up every day and things like Airbnb making accommodations much more affordable, you’ll probably be traveling more than you think you will.

A lot of study abroaders will also tack on extra travel either before or after their semester abroad. You’re already there, so why not make the most of that expensive plane ticket and really see as much of the world as you can? Don’t forget about those sneaky visa and/or reciprocity fee requirements, though. These could apply to any other countries you’re traveling to during your time abroad, so either budget accordingly or only pick countries where these don’t apply.

Money for Coming Home

The end of the semester is definitely the cheapest part of studying abroad, but it’s unfortunately still not free.

Preparing for departure

The top thing study abroaders spend money on at the end of the semester is souvenirs. Between the tokens you got to remember your time abroad and whatever else you can fit in your bag for your family/friends, these can set you back a pretty penny. Don’t forget about paying to bring (or ship) home anything you can’t fit in your bag. If you arrived with two 50-pounders, chances are you’ll be returning home with three.

Celebrating homecoming

Once you get home, you’re probably going to want to immediately stop at your favorite burrito joint to get that sweet fixin’ you’ve been missing. You’re also going to want to go out with friends, family, your significant other, your cat, etc. Save a little money in that bank account for restaurants or bars.

Transcript request costs from host university

Study abroad credits don’t usually transfer without an official transcript, and an official transcript won’t usually be provided for free. Better to leave a little extra cash in your bank account for these bad boys.

Bonus! How to Make Your Semester Cheaper

The best way to knock some dolla dolla off is to apply for as many scholarships as you can. These can be through your program provider, home university, and/or department/major, and can be either diversity, merit and/or need based. Don’t be afraid to apply to some government grants, too, especially if you’re doing any type of service or unique program. Here’s our guide to finding scholarships for study abroad.

Another tip to save a little money is to keep an eye on program deadlines. Sometimes program providers will offer discounts for early applicants, so just by submitting your application a few weeks earlier than planned, you could save hundreds.

So, how much do I really need to save for study abroad?

It’s ok to kind of be perplexed right now, there are a lot of factors to think about. Start by compiling as much information as you can with general estimates. Then plug them into our free tool to help calculate how much money you’ll need for study abroad.

Just having a ballpark number will help you plan so much better. It’s a common myth that study abroad is always super expensive, but it really doesn’t have to be if you prepare properly.

More money-saving tips for study abroad:

How to Save Money While Studying Abroad in London